Save 10% on All AnalystPrep 2024 Study Packages with Coupon Code BLOG10.

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Try Free Trial

- Try Free Trial

Back

CFA® Exam

Level I

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level II

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level III

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

- Mock Exams

ESG

- Study Packages

- Study Notes

- Practice Questions

- Mock Exams

Back

FRM® Exam

Exam Details

- About the Exam

- About your Instructor

Part I

- Part I Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Part II

- Part II Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Back

Actuarial Exams

Exams Details

- About the Exam

- About your Instructor

Exam P

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Exam FM

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Back

Graduate Admission

GMAT® Focus Exam

- Study Packages

- About the Exam

- Video Lessons

- Practice Questions

- Quantitative Questions

- Verbal Questions

- Data Insight Questions

- Live Tutoring

Executive Assessment®

- Study Packages

- About the Exam

- About your Instructors

- Video Lessons

- EA Practice Questions

- Quantitative Questions

- Data Sufficiency Questions

- Verbal Questions

- Integrated Reasoning Questions

GRE®

- Study Packages

- About the Exam

- Practice Questions

- Video Lessons

corporate-finance-cfa-level-2cfa-level-2

12 May 2021

Here are some of the most common mistakes managers make when evaluating capital budgeting decisions:

- Economic responses: Failure to incorporate economic responses into investment analysis can greatly affect the profitability of the investment. Attractive investments entice competitors to enter, consequently reducing profitability.

- Template errors: Employees may input the wrong information into the template leading to inaccurate capital budget analysis results.

- Pet projects: These are projects that influential managers want the company to invest in, but that may not begenerally accepted as profitable. More often than not, managers will exaggerate the profitability of these projects to make sure they are selected.

- EPS, Net income, or ROE: Many investments, even those with a high NPV, do not increase earnings per share (EPS), net income or return on equity (ROE) in the short run. Since many managers sometimes have short-term incentives, they may end up choosing projects that do not align with the company’s long-term interests.

- Basing decisions on the IRR: Investing in mutually exclusive projects based on the IRR alone will result in managers choosing projects that are smaller and based on short-term profits at the expense of larger, longer-term projects with high NPVs.

- Bad accounting of cash flows: When handling complicated projects, it easy to overlook relevant cash flows, mishandle tax, and double count cash flows.

- Overhead costs: Poor investment decisions can be made when a company over- or underestimates overhead costs.

- Discount rate errors: High-risk projects should not be discounted at the company’s overall cost of capital but at its required rate of return (RRR). This is because discount rates have a huge impact on the computed NPVs of long-term projects.

- Overspending and underspending the capital budget: Some managers will spend their whole budget and claim the budget was not sufficient. Remember that capital budgeting is the process of allocating resources to the most efficient uses.

- Failure to consider investment alternatives.

- Sunk costs and opportunity costs: The biggest failure in analysis is when sunk costs and opportunity costs are ignored. Only opportunity costs should be included in the cost of the project and sunk costs should be ignored.

Question

Which of the following is the most likely effect of bad accounting of cash flows on the capital budgeting process?

- It has no significant effect on the capital budgeting process.

- Mishandling of taxes and omitting relevant cash flows leads to an inaccurate NPV, thus affecting the choice of project.

- The required rate of return is the only factor that influences the capital budgeting process.

Solution

The correct answer is B.

Estimation of taxes and cash flows form the basis of the capital budgeting process hence omission of such information will result in an inaccurate NPV.

A is incorrect.Bad accounting of cash flows will affect the capital budgeting process since overlooking relevant cash flows will lead to a project being over valued or under-valued.

C is incorrect.Several other factors including the RRR affect the capital budgeting process.

Reading 19: Capital Budgeting

LOS 19 (f) Describe common capital budgeting pitfalls.

Shop CFA® Exam Prep

Offered by AnalystPrep

Level I

Level II

Level III

All Three Levels

Featured

View More

Shop FRM® Exam Prep

FRM Part I

FRM Part II

Learn with Us

Shop Actuarial Exams Prep

Exam P (Probability)

Exam FM (Financial Mathematics)

Shop Graduate Admission Exam Prep

GMAT Focus

Executive Assessment

GRE

Daniel Glyn

2021-03-24

I have finished my FRM1 thanks to AnalystPrep. And now using AnalystPrep for my FRM2 preparation. Professor Forjan is brilliant. He gives such good explanations and analogies. And more than anything makes learning fun. A big thank you to Analystprep and Professor Forjan. 5 stars all the way!

michael walshe

2021-03-18

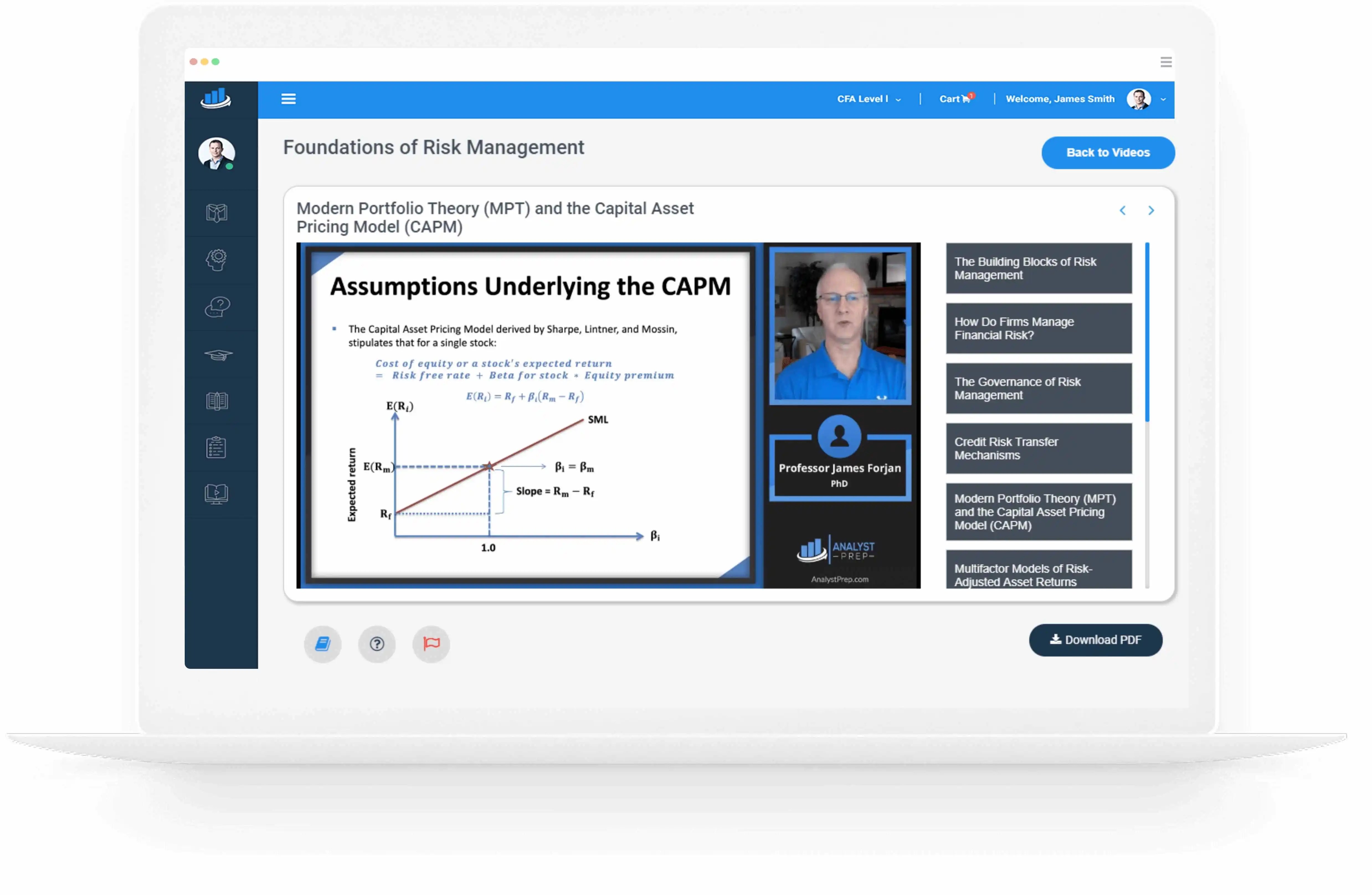

Professor James' videos are excellent for understanding the underlying theories behind financial engineering / financial analysis. The AnalystPrep videos were better than any of the others that I searched through on YouTube for providing a clear explanation of some concepts, such as Portfolio theory, CAPM, and Arbitrage Pricing theory. Watching these cleared up many of the unclarities I had in my head. Highly recommended.

Nyka Smith

2021-02-18

Every concept is very well explained by Nilay Arun. kudos to you man!

Badr Moubile

2021-02-13

Very helpfull!

Agustin Olcese

2021-01-27

Excellent explantions, very clear!

Jaak Jay

2021-01-14

Awesome content, kudos to Prof.James Frojan

sindhushree reddy

2021-01-07

Crisp and short ppt of Frm chapters and great explanation with examples.

Trustpilot rating score: 4.7 of 5, based on 61 reviews.

Related Posts